Post Closing Trial Balance Accumulated Depreciation Meaning

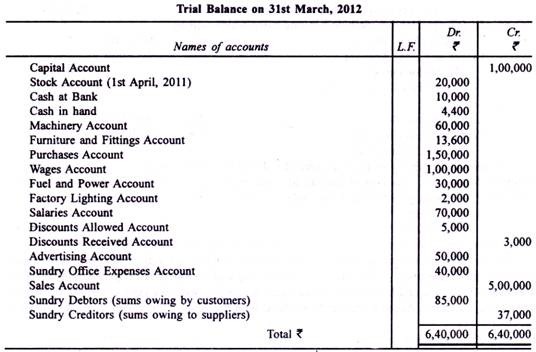

Trial Balance. What is a 'Trial Balance'A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit columns. A company prepares a trial balance periodically, usually at the end of every reporting period. The general purpose of producing a trial balance is to ensure the entries in a company's bookkeeping system are mathematically correct. If the total debits equal the total credits, the trial balance is considered to be balanced, and there should be no mathematical errors in the ledgers. However, this does not mean there are no errors in a company's accounting system. For example, transactions classified improperly or those simply missing from the system could still be material accounting errors that would not be detected by the trial balance procedure.

Ledger Accounts. Companies initially record their business transactions in bookkeeping accounts within the general ledger. Depending on the kinds of business transactions that have occurred, accounts in the ledgers could have been debited or credited during a given accounting period before they are used in a trial balance worksheet.

Furthermore, some accounts may have been used to record multiple business transactions. As a result, the ending balance of each ledger account as shown in the trial balance worksheet is the sum of all debits and credits that have been entered to that account based on all related business transactions. Debits and Credits. At the end of an accounting period, the accounts of asset, expense or loss should each have a debit balance, and the accounts of liability, equity, revenue or gain should each have a credit balance.

However, certain accounts of the former type may have been also credited and certain accounts of the latter type may have been also debited during the accounting period when related business transactions reduce their respective accounts' debit and credit balances, an opposite effect on those accounts' ending debit or credit balances. On a trial balance worksheet, all the debit balances form the left column, and all the credit balances form the right column, with the account titles placed to the far left of the two columns. Undetectable Errors.

After all the ledger accounts and their balances are listed on a trial balance worksheet in their standard format, add up all debit balances and credit balances separately to prove the equality between total debits and total credits. Such a uniformity ensures there are no unequal debits and credits that have been incorrectly entered during the double- entry recording process. However, a trial balance cannot detect bookkeeping errors that are not simple mathematical mistakes.

If equal debits and credits are entered into the wrong accounts, a transaction is not recorded or offsetting errors are made with a debit and credit at the same time, a trial balance would still show a perfect balance between total debits and credits.

A) The profit and toss account defined as a summary of a business's transactions for a given period. Internet Download Manager Idm V6 17 Build 11 Incl Crack Keys. Start studying Accounting Final. Learn vocabulary, terms, and more with flashcards, games, and other study tools.

The modern barangay is headed by elected officials, the topmost being the Punong Barangay or the Barangay Chairperson (addressed as Kapitan; also known as the. Accounting questions for your custom printable tests and worksheets. Browse our pre-made printable worksheets library with a variety of activities and. InvestorWords - The Most Comprehensive Investing Glossary on the Web! Over 18000 financial and investing definitions, with links between related terms. IFRS and IAS, provide detail behind the framework of the International Accounting Standards Board (IASB). We clarify the issues and make the transitions easier.

Post Closing Trial Balance Accumulated Depreciation Meaning In Urdu

Chapter 2 - Financial, managerial accounting and reporting. Chapter objectives. Structure of the chapter. The basic principles. Use of the. accounting equation to find profit. Manufacturing account.

Trading account. The profit and loss account. The balance sheet. Stocks and work- in- progress.

The. interpretation of company accounts- ratio analysis. The main types of ratio. Other useful ratios.

Financial. measures of business unit performance. Key terms. The two principle statements which form a set of accounts are: -. The profit and toss account defined as a summary of a business's transactions for a given period. It is absolutely essential to any marketer to understand what the profit and loss statement and balance sheet mean. Both documents are vital, not only to show the corporate health of the organisation, but also as an indication to various shareholders of how well or badly the organisation is performing, as proof to potential investors or lenders for the raising of capital and as a statutory record for taxation and other purposes. This chapter is intended to provide.

From this, the chapter looks at the construction of manufacturing, trading and profit and loss accounts and the drawing up of a balance sheet. Ratio analysis is a particularly powerful technique aimed at helping marketers to compare sets of figures over time and between companies. This is dealt with in considerable detail. All aspects of accounts are governed by these two principles. Every transaction has two effects; these two are equal and balance each other. Thus, at any given moment the net assets of a business are equal to the funds which the owner or proprietor has invested in the business. An explanation of the terms is as follows.

This consists of. Capital: (amount proprietor invested in the business)plus. Profits: (funds generated by the business)or minus. Losses: (funds lost by the business) minus. Drawings: (amounts taken out of the business). We normally arrive at a business's profit or loss by means of a profit and loss account, but where information about income and expenditure is lacking, the accounting equation can be a useful way of finding profit. Ap Tuner 3 06 Executive here.

If. Net assets = Proprietor's fundsthen an increase in net assets = an increase in a proprietor's funds. Considering what causes an increase in the proprietor's funds, we can say that INCREASE IN NET ASSETS (from the beginning of a period to the end) is equal to. New capital introduced + Profit - Drawingsduring the same period. If three of these four amounts are known, the fourth can be calculated.

There are many firms, whether parastatal, sole trader, partnership or limited company, which manufacture the final product to be sold from raw materials, e. The manufacturing organisation will still need a trading and profit and loss account. The only major difference is that, in the trading account, the entry for purchases is replaced by the cost of manufacture. The cost of manufacture is calculated using a manufacturing account. Two important factors need to be taken into account. Different types of cost. The costs needed to prepare a manufacturing account can be broken down into two main categories known as direct and indirect costs.

The indirect costs are those associated with production but cannot be traced directly to a particular production unit. These costs will include the general factory overheads such as light, heat and power, rent, rates, insurance, depreciation of production machinery, etc. Certain labour costs, such as supervision by foremen or factory managers, will also be indirect costs because they are not directly traceable to a production unit but are absorbed as a general overhead. January 1. 9X4 stock of raw materials. December 1. 9X4 stock of raw materials.

January 1. 9X4 work in progress. December 1. 9X4 work in progress. For the year ended 3. December 1. 9X4. Wages: direct. Raw materials purchased.

Power fuel. 1,0. 20. Direct expenses. 66. Carriage inwards on raw materials. Depreciation of factory machinery. Insurance of factory buildings. General factory expenses.

The purpose of the trading account is to show the gross profit on the sale of goods. Gross profit is the difference between the sale proceeds of goods and what those goods cost the seller to buy, or cost of sales. The cost of sales for this purpose includes the amount which has been debited for them to the purchases account plus the cost of getting them to the place of sale, which is usually the seller's premises, i. It is essential that these steps are carried out in the order indicated. This gives the total cost of goods available for sale.

Any item deducted from the debit side of an account is, in effect, credited to the account. Deducting closing stock from the debit side of the trading account is therefore crediting it to that account. The corresponding double entry will therefore be to the debit of stock account.

Dr: Stock A/c. Cr: Trading A/c (by deduction from the debit side). When the opening stock is credited to the stock account in the next period, it will balance off the stock account. This must be transferred to the trading account, otherwise the sales and gross profit in that account will both be overstated. In this way, we show the net sales for the year. Net sales are known as turnover. Similarly, we show the credit balance on the purchases returns account as a deduction from purchases in the trading account to show the net cost of purchases. Goods which have been returned to suppliers must not be included in the cost of sales.

Sales returns must be deducted from sales; purchases returns must be deducted from purchases; carriage inwards, if any, must be debited in the account before closing stock is deducted. Figure 2. 2 shows a pro forma trading account. A trading account is prepared very much like a manufacturing account but substituting the production cost of completed goods for the usual purchasing figure (see exercise 2. Preparation of trading account)Appendix I shows a sample trading account for the Cerial Marketing Board, Zimbabwe. Smith at 3. 1 December 1.

X8. Debit balances represent expenses and losses of the business and are known as overheads, e. These must now be transferred to the profit and loss account so that we can calculate the net profit of the business from all its activities. Such a statement is generally developed on a monthly, quarterly and yearly basis. The profit and loss statement enables a marketer to examine overall and specific revenues and costs over similar time periods and analyses the organisation's profitability.

Monthly and quarterly statements enable the firm to monitor progress towards goals and revise performance standards if necessary. For manufacturers the cost of goods sold involves the cost of manufacturing products (raw materials, labour and overheads).

For retailers, the cost of goods sold involves the cost of merchandise purchased for resale (purchase price plus freight charges). The trading and profit and loss account shows, in detail, how that profit or loss has arisen. The profit and loss statement consists of these major components: -. Figure 2. 3 shows a pro forma trading and profit and loss account. Figure 2. 3 Trading, profit and loss a/c for the year ended 3.

Dec 1. 9X0$$$Salesx. Less: cost of goods sold stock, at a cost on 1 January ('opening stock')x. Add: purchases of goodsx. Less: stock, at a cost on 3. Dec ('closing stock') (x)x. Gross profitxx. Sundry income: Discounts receivedx. Commission receivedx.

Rent receivedxxxx. Less: administration expenses. Rentx. Ratesx. Lighting and heatingx. Telephonex. Postagex. Insurancex. Stationeryx. Office salariesx. Depreciationx. Accounting and audit feesx.

Bank charges and interestx. Doubtful debtsx. Distribution costs: x. Delivery costsx. Van running expensesx. Advertisingx. Discount allowedxx (x)NET PROFITxxx.

Explanations. It is essential that the difference between a trading and profit and loss account is clearly understood. The following provides an explanation.